Key information

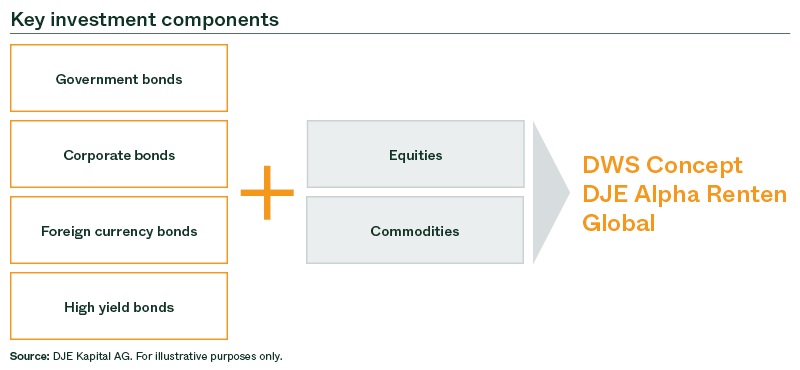

This fund focuses its investments on bonds from domestic and foreign issuers, participation certificates, convertible bonds and warrant bonds. Domestic and foreign stocks may comprise up to 20% of fund assets. This level can be tactically increased by 10% through the use of derivatives. Overall the fund maintains a balanced mix of securities with the goal of achieving a reasonable return. The focus of investments is on high-quality bonds. In selecting equities, the fund managers analyse companies using quantitative and qualitative criteria.

Responsible manager since inception

Responsible manager since 15/02/2022 as co-manager

Key information

| ISIN: | LU0087412390 |

| WKN: | 974515 |

| Category: | Fund EUR Cautious Allocation - Global |

| Minimum Equity: | - |

| Partial Exemption of Income ¹: | - |

| VG/KVG: | DWS Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 2 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | accumulation |

| Financial Year: | 01.07. - 30.06. |

| Launch Date: | 30/04/1998 |

| Fund currency: | EUR |

| Fund Size (23/04/2024): | 631,65 Mio EUR |

| Ongoing Charges p.a. (30/06/2020): | 1,40 % |

| Reference Index: | - |

Fees

| Initial Charge: | 2,000 % |

| All-in fee p.a.: | 1,35 % |

| Advisory Fee p.a.: | 0,40 % |

Ratings & Awards (23/04/2024)

| Morningstar*: |

|

|

Awards: Best Asset Manager 2023 2nd place out of 326 funds in the category "Defensive" in the ranking of Wirtschaftswoche and MMD |

no esg data available

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (23/04/2024) |

|

|---|---|

| Standard Deviation (1 years): | 3,95 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -2,49 % |

| Maximum Drawdown (1 year): | -4,39 % |

| Sharpe Ratio (1 years): | 0,30 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 29/02/2024

Top Country Allocation in % of Fund Volume (28/03/2024) |

|

|---|---|

| United States | 31,60 % |

| Germany | 23,90 % |

| Other Countries | 8,90 % |

| Italy | 8,50 % |

| Finland | 5,90 % |

Asset allocation in % of the fund volume (28/03/2024) |

|

|---|---|

| Bonds | 75,70 % |

| Stocks | 19,00 % |

| Cash | 1,20 % |

| Funds | 0,90 % |

Investment strategy

The fund takes advantage of the cyclical interplay between the asset classes bonds and equities. The focus is on international bonds, both corporate and government bonds, in various currencies. The fund also takes advantage of selected opportunities on the equity markets. This allows it to diversify when bonds are temporarily weak and to achieve a positive long-term performance. The allocation between equities, bonds and cash as well as the analysis of the equity and bond markets is based on the FMM method, the proven investment approach of DJE Kapital AG (for more information on the FMM method, please visit www.dje.de). The broad diversification across different asset classes forms the basis for a favourable risk/return ratio.

Chances

- The fund frequently makes full use of the equity investment option to profit from rising equity markets

- Participation in a balanced portfolio of equities, bonds and foreign currencies

- Our professional team takes advantage of the opportunities offered by volatile markets

Risks

- Issuer country and credit risks as well as currency risks

- Equity prices may exhibit relatively strong fluctuations depending on market conditions

- Price drops in the money and capital markets when interest rates rise

Target group

Der Fonds eignet sich für Anleger

- who wish to reduce risk compared to a direct investment

- with a medium to long-term investment horizon

- who seek broad investment diversification to reduce risk

Der Fonds eignet sich nicht für Anleger

- who are not prepared to accept increased volatility

- with a short-term investment horizon

- who seek safe returns

Monthly Commentary

The fund management extended the duration of the bonds over the course of the month in order to participate in the price increase on the bond side. The average remaining term of the bonds (including derivatives) was 3.67 years at the end of the month and was therefore slightly longer compared to the end of February (3.02 years). A German federal bond and a short US government bond were reduced in the fund's basic portfolio. Furthermore, profits were realized on a bond from the renewable energy sector. On the other hand, the travel sector was further expanded by strengthening the existing arrangement. Due to the positive equity sentiment, the equity quota has been increased. At the sector level, positions were built up in companies from the technology and pharmaceutical sectors. Utilities and travel stocks were also purchased. The weighting of logistics stocks has been reduced. At the end of March, the equity quota including derivatives was 29.46%, significantly higher compared to the previous month (22.34%). The US dollar exposure was not hedged. The DWS Concept DJE Alpha Renten Global was able to benefit from the positive market environment and achieved a monthly performance of 1.87%.

The source of all information and responsibility for its content and preparation lies with DJE Kapital AG, unless otherwise stated. The Management Company and Distributor of the Fund is DWS Investment GmbH. The statements contained in this document reflect the current assessment of DJE Kapital AG. The opinions expressed are subject to change without notice. All information in this overview has been provided with due care in accordance with the state of knowledge at the time of preparation. However, no guarantee or liability can be assumed for the correctness and completeness.

Sales prospectus and further documents

The supervisory and regulatory documents as well as the factsheet for this fund are available on the website of the investment company under the following link: DWS Concept DJE Alpha Renten Global LC